Sunday, July 02, 2006

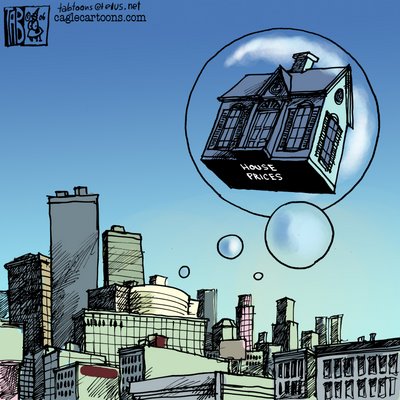

Housing: Where the Market is Really Heading

"Amid all the ups and downs in the housing data of late, how you feel about the direction of this year's most closely watched economic sector may well depend on which day of the week you check the news." You can read the full article by James Cooper entitled, "Housing: Where the market is really heading," in the July 10th issue of BusinessWeek.

"Looking past all the recent month-to-month noise in the numbers, it's clear that demand for both new and existing homes is down from last year's peaks, and that the growth rate of prices continues to slow. However, the drop in sales is not as steep as the data had suggested earlier in the year. Sales are declining in an orderly fashion, not collapsing, and that pattern will most likely continue for the rest of the year."

Here's what Christopher Cagan, PH.D., director of research at First American Real Estate Solutions, has to say in his paper entitled, “The Real Estate Cycle in 2006,” dated May 18, 2006.

“The residential real estate market stands at a pivotal position in the spring of 2006. Over the previous few years, home prices have risen rapidly almost everywhere. In many coastal areas, prices have more than doubled since 2000. In recent months, the market has returned to more normal conditions. In many places, the inventory of properties offered for sale has increased. Buyers no longer rush to meet or exceed the asking prices of sellers. In some cases sellers have reduced their prices. On the whole, price appreciation has slowed down or flattened, but there has been no crash. Depending on the local area, prices are rising at single-digit levels, flattening out, or slightly declining – in other words, conditions have returned to normal after a very strong bull market.”

Finally, David Lereah, the chief economist for the National Association of Realtor's was asked in an interview; "Do you think the housing market could ever crash?" Here's his answer;

"I'm getting tired of all these doomsayers. We live in houses, and our houses are not going to crash. This isn't the stock market.... Local economies are relatively healthy. There's job creation -- this isn't a scenario where bubbles burst. Can there be one or two or three or several local markets where prices actually go down? Yes. But to generalize for 30 markets or the whole real estate marketplace -- that's absurd."

"Why the Bubble Won't Burst," interview with Michael Youngblood, Managing Director of Friedman Billings Ramsey & Co.

Housing Bubble Prospects Question and Answers provided By NAR.

You can also view the Anti Bubble Reports on their website for Market-by-Market Home Price Analysis Reports.

Labels: Bay Area Real Estate, BusinessWeek, First American Real Estate Solutions, NAR, Real Estate Bubble, Real Estate Cycles

Links

Links